Lesson 3 - Statements and Budgets - Part 8

Income Statement

Now that we’ve learned about the Balance Sheet and its major components, it’s time we look at the next tool available to us, the Income Statement.

Our Income Statement will provide us with a detailed breakdown of cash income and expenses over a past period, letís say one year. The Income Statement will let us know how well we performed in the past year and can help us to make decisions for budgeting our next year.

The Income Statement is broken down into two major parts, Income and Expenses.

Income

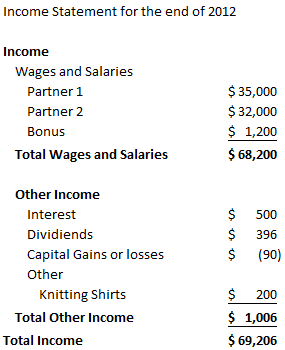

Income will consist of cash that we receive known as inflows. In most cases the majority of cash inflows will come in the form of wages or salaries. There is also income from a number of other areas as well such as interest from savings accounts, dividend payments from stock and so forth. Letís take a look at the Income portion of our Income Statement.

Here we see the major source of income was from our Wages and Salaries. We also earned interest from our savings account as well as cash from dividends on stock. However, over the course of the year our stock holdings lost 90 dollars. Please remember that when we save money for our Future Goals, that we do not count the interest earned as Income. This is put on our Balance Sheet, if we put it on the Income Statement, it means that it can be spent, thus we would earn no Interest on the Money and we would have to contribute more to meet our Future Goals. We also earned some money because we can Knit Shirts and sold some to friends, this is also included in our statement.

Comments

Please Join or Login to Join the Conversation