Lesson 3 - Statements and Budgets - Part 15

The Monthly Budget

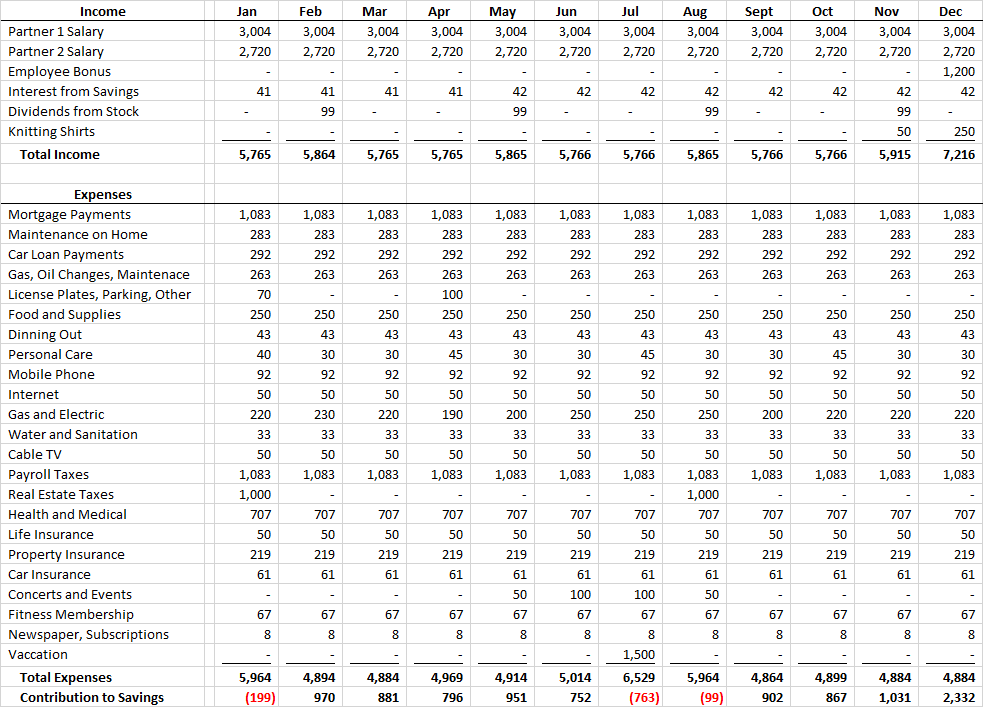

Letís take a look at our Monthly Budget:

We can take the items from our Master Budget and break them down to our Monthly Budget. Here we can see exactly what the income and expenses are, but more importantly, we can see when our income and expenses occur. We should notice that in January we donít have enough Income to cover all of our Expenses.

We have estimated that we will fall short by $199 dollars. We also have this situation occur in July and August where our Income is less than our Expenses. If we have money left over from last year (Contribution to Savings Ė Savings Goals) we would put it in the checking account so that we can cover this future $-199 shortfall. Last year we had a Contribution to Savings of $8,944 and our Savings Goal was $8,000, so we are left with $944 in the checking account. This will be more than enough to cover the shortfall in January.

The two shortfalls in July and August can also be paid out of the Contribution to Savings. Remember that at the end of the year we will still have $8,341 for our Contribution. The three months of shortfall are already calculated for the entire year and not just a single month.

But what happens if we still donít have enough to cover our shortfall? We have a few more options, firstly we could try to put off the expense until a later date when the money is available. Secondly we could possibly reduce our Flexible expenses, or lastly we could borrow the money temporarily to meet the shortfall. Borrowing money to meet our shortfalls should only be a last resort if we are not able to, for we must pay interest and fees when we do.

This is why it is important that we break the Master Budget down into a Monthly Budget, because we might have shortfalls where our Income is less than our Expenses. Our Master Budget might be positive and we might have the required Contribution to Savings, but that doesnít mean we wonít come up short from month to month. We donít want this to surprise us, but it is ok to have shortfalls as long as we have a plan to overcome them.

Comments

Please Join or Login to Join the Conversation