Lesson 3 - Statements and Budgets - Part 7

Net Worth

The last Item is our Net Worth. Again, the Balance Sheet only tells us how much we have and how much we owe at the exact time we are completing it. It does not tell us how much we were previously worth or how much we will be worth in the future.

We find the total Net Worth by taking our Total Assets and subtracting them from our Total Liabilities.

Our Net Worth is affected by two different factors. The first being whenever our income is greater than our expenses in a given period. If we make more than we spend we will have a positive contribution to savings and our Net Worth will rise as an effect. If we spend more than our income we will have just the opposite and have a dissaving and a reduction in Net Worth.

The second is when assets that we own increase or decrease in value. If our home increases in value it will cause our Net Worth to increase also. However, if our home value decreases, then our Net Worth will also decrease in stride.

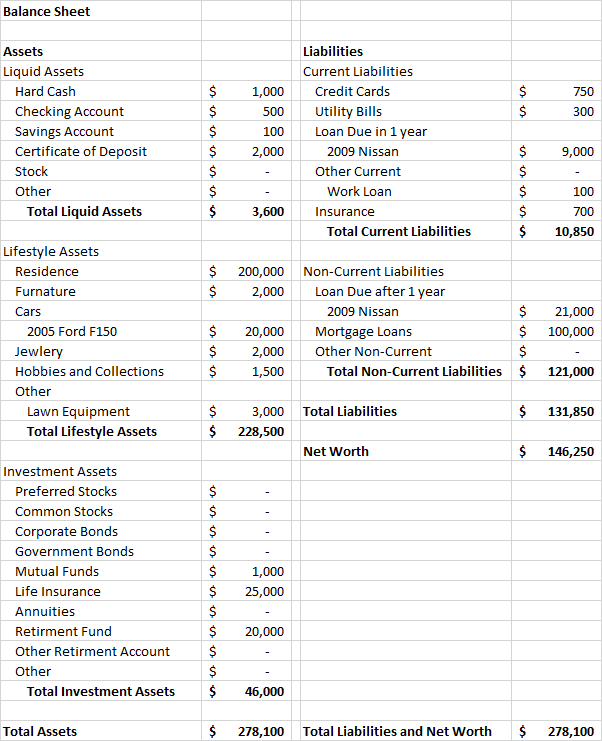

Let’s Take a Look at a more detailed Balance Sheet, broken down into the categories we talked about. View and Download an Excel Version.

It might seem like a daunting task when looking at everything, but remember to just take each item as it comes and soon enough we are finished. Here we have all of our Assets on the left and Liabilities on the right. At the bottom we total up everything adding the Liquid Assets, lifestyle Assets and Retirement Assets together. On the Liabilities side we add our Current and Non-Current Liabilities together. To find our Net Worth we need to take our Total Assets and subtract our Total Liabilities.

To make sure we have a balanced statement, we will add the Total Liabilities and Net Worth to make sure it equals our Total Assets, thus the Balance Sheet is balanced.

Comments

Please Join or Login to Join the Conversation