Lesson 3 - Statements and Budgets - Part 13

The Cash Budget

Generally we will prepare two Budgets, the Master Budget will detail the entire year and the Monthly Budget which will describe only one month at a time.

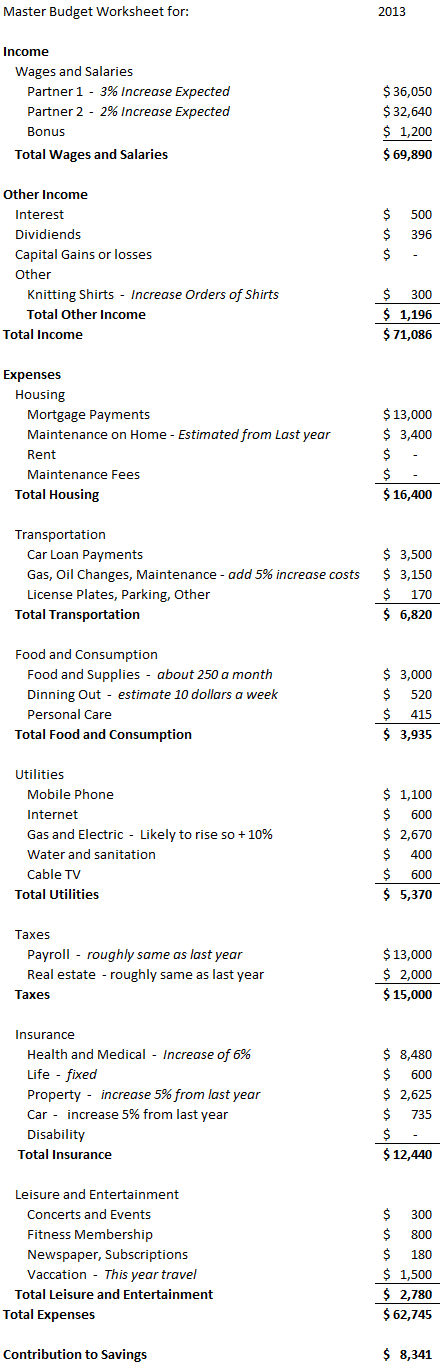

Master Budget

Generally we will work from the high level Master Budget and then break it down into a Monthly Budget. If we started our budget at the beginning of the year, we will try to forecast what our total Incomes will be and our total Expenses over the rest of the year. While some Incomes and Expenses will be easy to forecast or estimate, others might not be. Our mortgage payment or rent and our car payment are two examples of Expenses that we know almost the exact amount.

Our Master Budget will look very similar to our Income Statement we just prepared. We should always try to set each Income and each Expense to be as realistic as possible. Often, a common problem is that we budget some things too low. If we are spending $50 a week on dinning out, then we shouldn’t budget $30. We have to be honest with ourselves, otherwise we are set up for failure.

As we can see, we can almost reuse the Income Statement for the Master Budget. We have gone through each item again, trying to decide if the amount we spent last year will be the same amount we will spend this year. We have included Notes in Italics, and we think some things will increase in cost. Here is also where we can increase a budget for something we went over on last year. For example, if we thought our Gas and Electric would only cost $300 and it ended up being $350, we might want to increase this 5 to 10 % past what it was, to allow for changes. We would rather over budget something slightly then come up short.

Remember, Interest earned for our Savings Goals is only included on our Balance Sheet.

Comments

Please Join or Login to Join the Conversation