Lesson 3 - Statements and Budgets - Part 18

Budget Performance

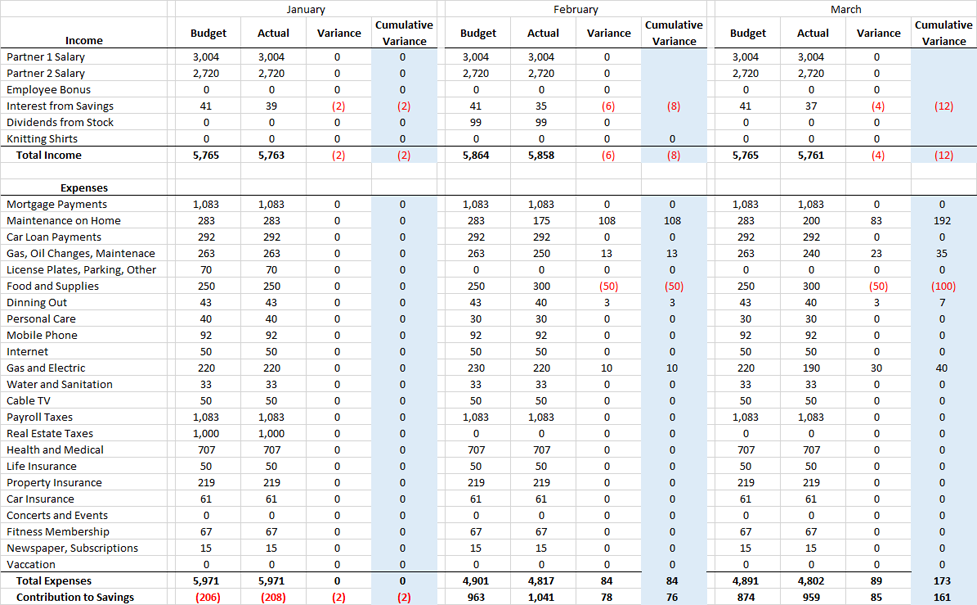

Let us take a look at another sheet that will help us measure the actual Income and Expenses with what we budgeted for.

Here we have a chart that will Monitor our Performance. Let’s take a look at January, we have our “Budget” from the Monthly Budget and next to it we have our “Actual” Income and Expenses. Sometimes what we Budget for on a Monthly Basis isn’t 100% accurate. If we look at January’s Income Section, we had “Budgeted” for $41 in “Interest from Savings” however, we “Actually” only got $39. Here we have an Unfavorable Variance of $2 dollars. All of our other expenses for January were exactly as we “Budgeted.”

Now, we knew that we would need $206 dollars to cover the shortfall in January, but since we didn’t make $41 dollars in “Interest from Savings” we now need $208 dollars to cover all of our Expenses. We should see that if our Actual Income was less than our Budgeted that we could end up needing more money to cover our Expenses.

In February we have a similar scenario with our Income, remember that we used money from checking or savings to cover January’s shortfall so we have less in the bank to earn interest. We should notice our “Cumulative Variance” column is keeping track of all the Variance’s that occur through every month. In January we were short on Income of $2 and now in February we are short on Income by another $6 dollars, making for a total of $8 dollars we are short by.

In February we also have some Favorable and Unfavorable Variance Expenses. Our “Maintenance on Home” category only used $175 of its $283 dollar budget, thus we have a Favorable Variance. However, on “Food and Supplies” we spent $300 dollars on a budget of $250 dollars for an Unfavorable Variance of $50 dollars.

We should be thinking about why each of these Variances occurred and remember that we either need to make an Adjustment to our Master and Monthly Budget or reduce other Expenses. Even when we have a total Favorable Variance of $84 in February, doesn’t mean that we shouldn’t be looking at whether we should adjust our “Food and Supplies” if we think we will continue to go over the budget.

At the end of each year we should also go back through each month to recap what happened in that month, were we under budget or over budget on our categories. This will help us monitor and ensure that we are saving for our current Goals and our future Goals.

Thank you for the spreadsheets, they really help

I agree.

that was a lot, head hurts now...