Lesson 3 - Statements and Budgets - Part 3

The Balance Sheet

We will use the Balance Sheet to answer a simple question, what are you worth right now? The Balance Sheet is designed to determine an individual’s wealth. Balance Sheets are usually made up of three different sections, Assets, Liabilities and Net Worth.

Your Net Worth is determined by this simple formula Net Worth = Assets - Liabilities

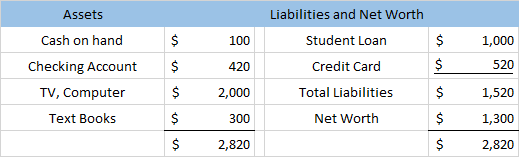

The world Balance in Balance sheet should imply to us that something on the sheet must balance. The example below shows us a simple Balance Sheet.

See how our items of value (Assets) are listed on the left and the money we owe others (Liabilities) is listed on the right. Both Sides must equal each other. This difference in Assets and Liabilities will be our Net Worth. Our Net Wealth can be a positive number or a negative one, it depends on how much value we have and how much in Liabilities we owe. In our example we have a positive Net Worth of $1,300 dollars. Meaning we have $1,300 more in value than what we owe to others.

We found our Net Worth by taking our Total Assets and subtracting out our Total Liabilities.

Net Worth = $2,820 – $1,520 = $1,300

So what can be considered an Asset? And what is considered a Liability? Great question, we will take a look at the three major types of Assets and the two major types of Liabilities next.

Comments

Please Join or Login to Join the Conversation