Lesson 2 - Value of Money - Part 10

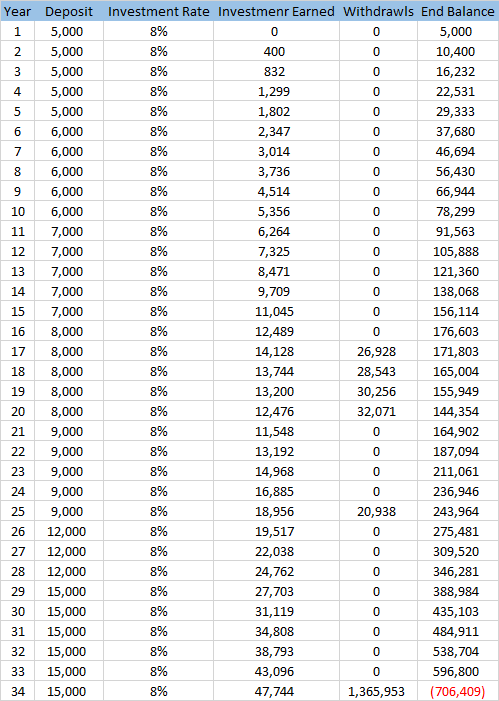

In order to adjust for the curve in earnings from our career we might have to put less into savings in the beginning and more in the later years when we achieve a higher earning potential. In the example below we try to calculate what would happen if we contribute more and more as time goes on. This is a common way of overcoming the curve in career earnings.

As we can see here, this savings plan is not adequate to save for all of our Goals. We will not be able to Retire at the end with our desired amount. This means that we must find another way of contributing to savings. As a rule of thumb, “experts” recommend savings anywhere from 10 to 15 percent of your pre-tax income. If we saved any less in the beginning we could end up having to borrow money to fund our future Goals. Instead of earning interest we will now owe interest on this borrowed money. While a large percent borrow money for higher education, it must eventually be paid back in a similar fashion as our savings plan. However, the amount we can put into our savings plan will be limited the more we borrow, making it harder to achieve our goals. In the hardest of cases, we might have to put off our Goals until a later time or surrender them all together. We might have to retire later on in life or give up our hopes of traveling around the world.

Comments

Please Join or Login to Join the Conversation