Lesson 2 - Value of Money - Part 11

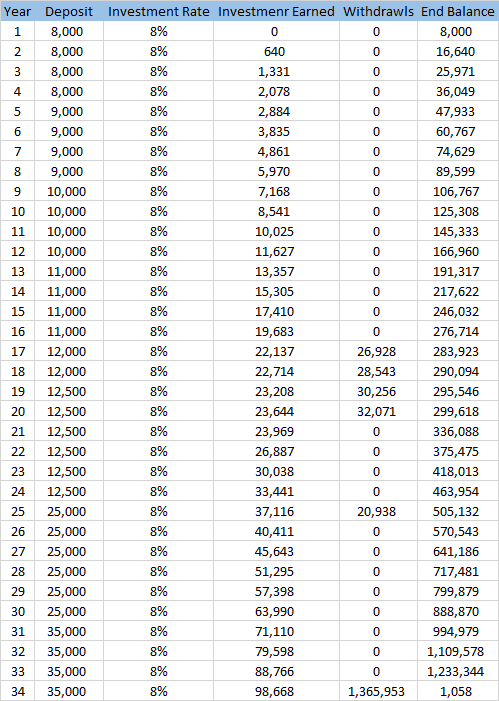

We have recalculated here to show a 3rd scenario. Like most people in their lives they will only be able to contribute a small amount in the beginning and more towards the end of their career. There is also the importance of paying off home loans and putting that money into savings. Most mortgages last anywhere from 15 to 30 years, after which time we can contribute more to our savings goals. Look over the Savings Plan below:

Here we have a Savings plan that will work. We have small savings in the beginning and gradual increase in savings as the years progress. We have a small balance left over at the end and all of our Goals are met.

Monitor Progress

Though we have a savings plan in place to meet our Goals, it is important that we continue to Monitor our progress. Sometimes our economy experiences rough patches, we need to be able to respond to these situations quickly. Failing investments or investments not earning enough interest will require us to contribute more to savings. Our Excel spread sheet is a very simple to use tool that can help us get a better understanding of how to plan for our future. Often it will never be accurate, as life changes we might add goals, remove goals, receive different interest rates, not be able to contribute because of an injury, job loss or a myriad of other situations.

This is why we must constantly Monitor our progress along the plan, making adjustments as we go. But we will at least have some idea of where we should be and how to get there.

We will talk about Investments in a latter lesson, but consider that in selecting investments we might have riskier investments that earn above our 8% for very long Goals, such as our Retirement. While having less risky investments for shorter Goals, such as our Child’s education Goal. Our spreadsheets at the moment only assume one interest rate, and this may change over time.

Comments

Please Join or Login to Join the Conversation